On November 5th, 2024, millions of people all around the world tuned in to watch the 2024 election play out. In nervous anticipation, both Trump and Harris supporters watched numbers go up for the two candidates—Kamala Harris and Donald Trump. Finally, early the next morning, Trump was able to claim victory, and Harris conceded the election soon afterward. Trump is scheduled to take office on January 20th, 2025. So, as the president-elect, what has Trump planned for America’s economy?

Let’s start by talking about Trump’s proposed tax policy. In 2017, during his previous presidency, Trump passed the Tax Cuts and Jobs Act, which reduced taxes for most Americans but disproportionately benefited the wealthy (Lobosco). This act is set to expire in 2025, but Trump is looking to renew it. In addition, Trump also wants to lower the top corporate tax rate from 35% to 15% and restore companies’ ability to deduct investments in equipment and research on their taxes (Lobosco). To appeal to blue-collar workers and senior citizens, Trump is proposing to end taxes on tips, social security payments, and overtime pay (Treene). However, these taxes currently help fund Social Security, thus cutting those could reduce benefits by 30% in 2031 (Lobosco).

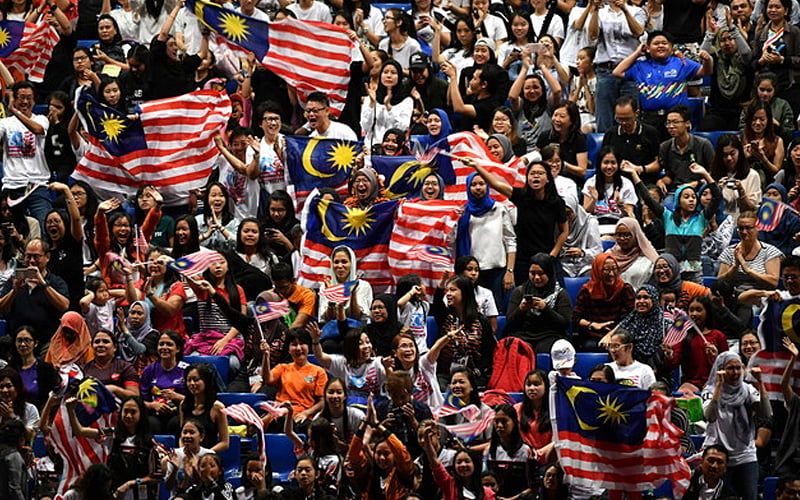

Trump has also supported the mass deportation of illegal immigrants in the United States. While the total number of illegal immigrants is unclear, experts estimate that it is around 11.7 million (Center of Migration Studies 1). Although he has not expressed how many people will be deported, nor the price of this mass deportation, this will require the cooperation of many federal agencies, including the Department of Justice and Border Patrol. Undocumented immigrants make up 5% of the American workforce, primarily in construction, restaurants, and agriculture (Center of Migration Studies 1). With such a portion of the workforce in danger of being deported, this will lead to a labor shortage in those areas, thus causing the economy to stall and prices to rise. However, even this is nothing compared to the tariffs he will introduce.

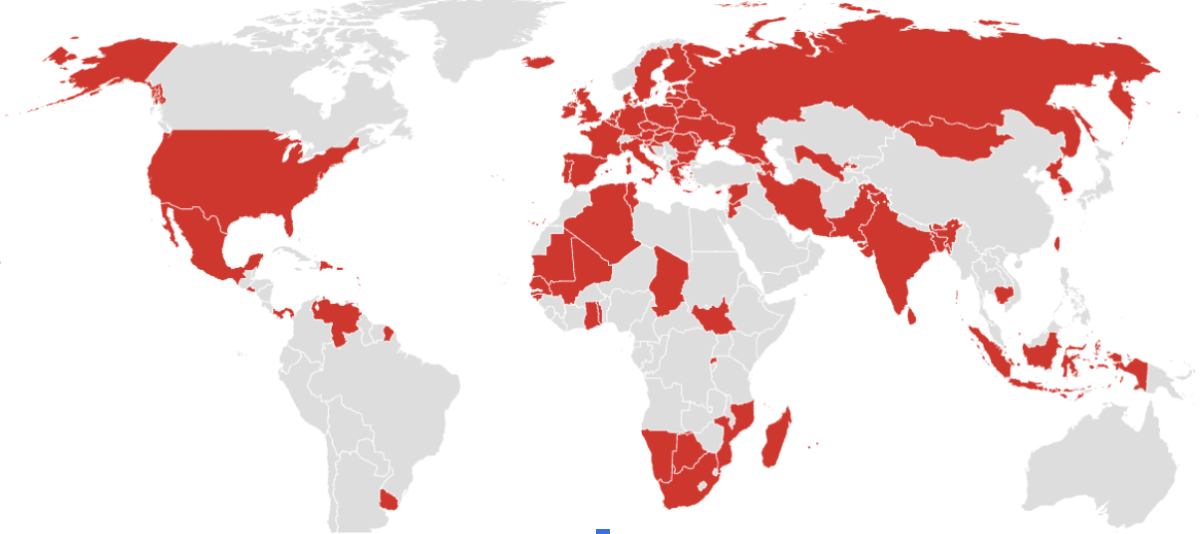

One of Trump’s most extreme economic proposals is his proposed tariff policy. Once in office, Trump promised to impose a 10-20% tariff on all imports and a 60-100% tariff on imports from China (Repko). These tariffs could drastically raise prices for almost every consumer good, as Chinese imports make up 20% of all imports to the United States. With the increase in prices, along with a nearly 6 times larger increase for Chinese products, Americans will need to pay more for their goods. In fact, a study from the National Retail Foundation found that the tariff plan would lead to “dramatic double-digit-percentage price spikes in nearly all six retail categories that [they] examine[d]” (Repko). Inflation and rising prices were some of the key reasons why voters voted for Trump in this election, but his proposed tariff plan seems to only worsen the issue.

As shown throughout this article, when Trump takes office in January, our nation’s economic policy will be greatly altered. First, he will enact drastic tax cuts and reduce funding for many government programs. Second, he has promised to carry out the mass deportation of millions of immigrants, which would take away a crucial source of labor. And lastly, he will enact what is perhaps the most extreme tariff policy in American history, which could lead to trade wars and increased prices on almost every consumer good.

Sources

Genung, Sean. “What Percentage of US Imports Is Made in China?” Global Trade Specialists, 19 Dec. 2019, www.mgtrading.com/what-percentage-of-us-imports-is-made-in-china/.

Lobosco, Katie, and Tami Luhby. “Here’s What Trump Is Proposing for the Economy | CNN Politics.” CNN, Cable News Network, 6 Nov. 2024, www.cnn.com/2024/11/06/politics/heres-what-trump-is-proposing-for-the-economy/index.html.

Picchi, Aimee. “5 Ways Trump’s next Presidency Could Affect the U.S. Economy – and Your Money.” CBS News, CBS Interactive, www.cbsnews.com/news/trump-election-impact-on-economy-taxes-inflation-your-money/. Accessed 7 Nov. 2024.

Repko, Melissa, and Gabrielle Fonrouge. “Trump’s Proposed Tariffs Could Raise Prices for Consumers and Slow Spending.” CNBC, CNBC, 6 Nov. 2024, www.cnbc.com/2024/11/06/trump-proposed-tariffs-consumer-prices.html.

Center for Migration Studies. “The Importance of Immigrant Labor to the US Economy.” The Center for Migration Studies of New York (CMS), 2 Sept. 2024, cmsny.org/importance-of-immigrant-labor-to-us-economy/#:~:text=According%20to%20estimates%20from%20the,5.2%20percent%20of%20the%20workforce.

Center for Migration Studies. “US Undocumented Population Increased to 11.7 Million in July 2023: Provisional CMS Estimates Derived from CPS Data.” The Center for Migration Studies of New York (CMS), 6 Sept. 2024, cmsny.org/us-undocumented-population-increased-in-july-2023-warren-090624/#:~:text=The%20total%20undocumented%20population%20increased,to%2010%20million%20in%202020.

Treene, Alayna, et al. “Trump Proposes Eliminating Taxes on Tips at Las Vegas Campaign Rally | CNN Politics.” CNN, Cable News Network, 10 June 2024, www.cnn.com/2024/06/09/politics/donald-trump-nevada-rally/index.html.

Welker, Kristen, and Alexandra Marquez. “Trump Says There’s ‘no Price Tag’ for His Mass Deportation Plan.” NBCNews.Com, NBCUniversal News Group, 7 Nov. 2024, www.nbcnews.com/politics/2024-election/trump-says-no-price-tag-mass-deportation-plan-rcna179178.

![Teacher [Milk] Tea: Part 2](https://bisvquill.com/wp-content/uploads/2024/03/Screen-Shot-2024-03-19-at-9.28.48-PM.png)